Section 321 is the strategy you are looking for,

year-round savings on every fulfillment order.

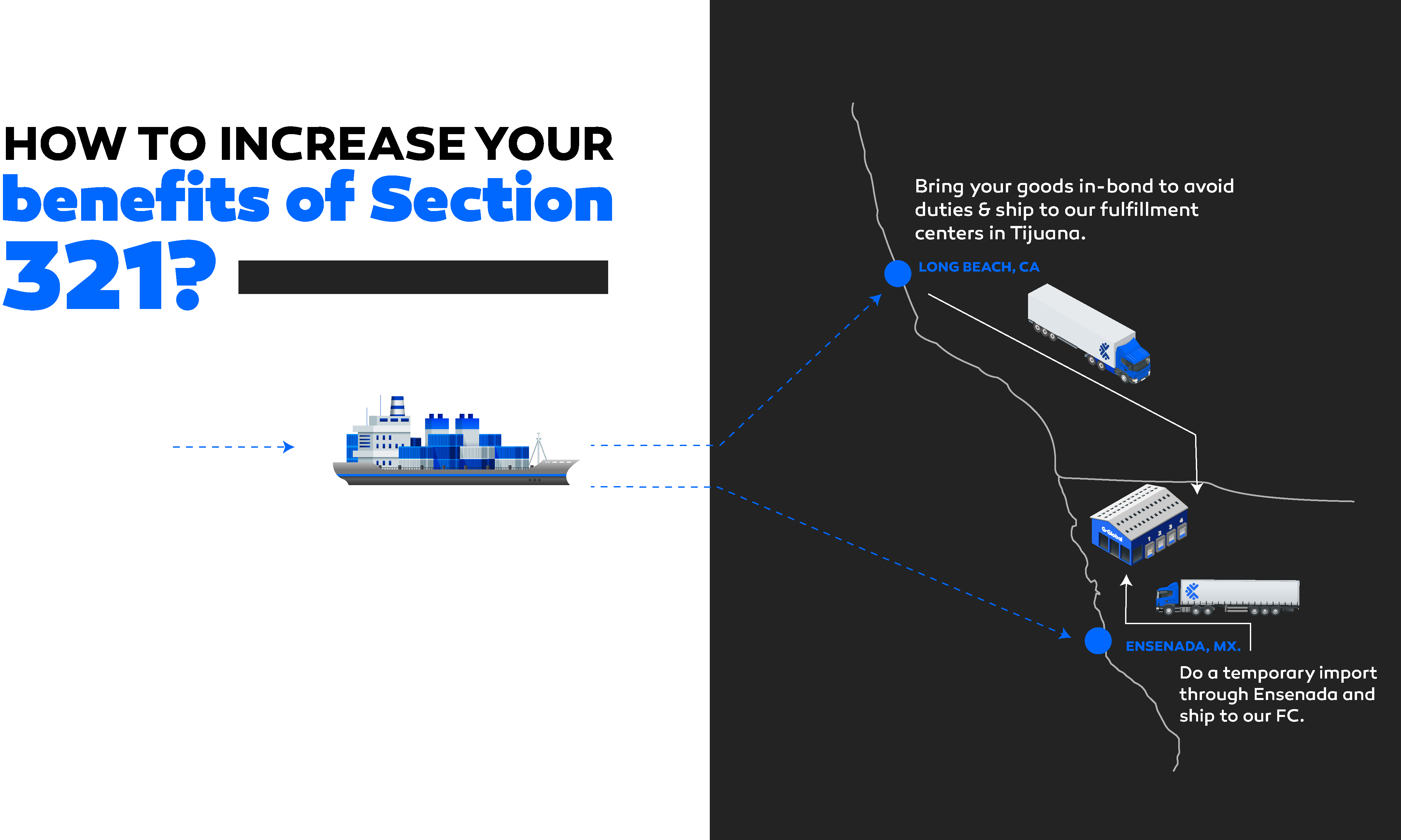

Experience the power of Section 321 – an efficient strategy that eliminates duties and maximizes cost savings. You can reinvest in your core business and revenue-generating activities with ease, as we streamline paperwork and significantly reduce crossing wait times. Our tailored technology ensures speedy clearance for thousands of entries in just minutes, empowering your seamless cross-border e-commerce.

Discover how Section 321 can transform your logistics and boost your bottom line!

More than just cost-effective fulfillment...

Unlock business growth with operational savings under Section 321

Let our experts calculate your new bottom-line with Section 321 - this is just the beginning of your journey to success! Here's how we make it happen:

- Automated processing: We streamline your operations, making them efficient and hassle-free.

- Save 365 days a year! Enjoy year-round savings that will redefine your bottom-line.

- Expand your cost-reduction strategy! Unleash the power of cost optimization and drive your growth.

Fill form and Download

Download Your Guide

To access the guide, simply enter your details below, and we'll send it directly to your inbox. If you have any questions or need further assistance, feel free to reach out to our team.

Enter your details below:

IMMEX program

Import goods into Mexico through our duty-free IMMEX program. Benefit from reduced real estate and labor costs while optimizing your supply chain.

Section 321

Seamlessly clear goods under <$800 in value through customs, with zero duties and taxes. We ensure a smooth process tailored to your needs.

Savings +15%

Experience a remarkable 15% increase in savings by uncovering untapped financial resources within your supply chain!

FAQs

FAQ: Section-321, customs clearance for duty-exempt efulfillment.

Is duty-free logistics possible?

Yes.

The main pillar to achieve tax-exempt custom clearance is possible by Section 321 Type 86. With the right customs broker and strategy, you can achieve a shorter processing time, heightened security, fortify your relationship with CBP, and of course, decrease logistics costs.

What is the Section 321 exemption?

Allows low-value shipments to enter the U.S. without having to pay the typical fees, tax, and duty associated with importation.

What are the requirements for Section 321 entry?

The shipment must not exceed $800 in value and must not be one of several lots covered by a single order or contract.

What is Section 321 daily restriction?

Allows low-value shipments to enter the U.S. without having to pay the typical fees, tax, and duty associated with importation.

Who else may qualify as “the one person”?

With respect to unsold merchandise, under the new administrative ruling, the owner of the merchandise (foreign seller) may also qualify as the “person” provided the owner’s identity is presented to CBP at the time of importation.

Will an IOR number be required for Entry Type 86?

Providing an IOR number is conditional for Entry Type 86, subject to applicable Partner Government Agency (PGA) requirements.

Is a POA (Power of Attorney) required for brokers to file Entry Type 86?

Yes, for purposes of this test customs brokers must be authorized to conduct customs business on behalf of the owner, purchaser, or consignee of eligible shipments through a valid power of attorney.

Do duites, taxes and fees, apply to Entry Type 86?

No. Shipments qualifying for Entry Type 86 are not subject to duties, taxes and fees. If the shipment requires fee collection (e.g. agricultural fees), filers must file a Type 01 Consumption or Type 11 Informal entry.

What is the difference between informal processing Section 321 and Entry Type 86?

Currently, shipments qualifying for de minimis treatment are subject to the release from manifest process, which cannot be used for PGA regulated commodities. Entry Type 86 will instead allow filing through ABI and can be used for PGA regulated commodities.

Are there goods that are not permitted to be filed under Entry Type 86?

Yes. Goods subject to Antidumping/Countervailing Duty (AD/CVD), goods subject to quota, certain tobacco and alcohol products, and goods taxed under the Internal Revenue Code, are not permitted to be filed under Entry Type 86.

May an entry filed to Section 321 duties be allowed for Entry Type 86?

Yes, barring subsequent notice to the contrary, an entry that is subject to Section 301 that meets de minimis requirements may currently be filed as an Entry Type 86.

How can I identify which merchandise can be filed with Section 321?

Now, it is important to consider that not all goods are eligible to take advantage of Section 321 filing. Therefore, it is essential to approach your trusted customs broker to define and classify which products could represent great savings with Section 321. Generalizing, eligibility will depend on merchandise subject to other regulating agencies that may need to inspect and clear your goods such as the U.S. Food and Drug Administration (FDA), Food Safety Inspection Service (FSIS), National Highway Transport and Safety Administration (NHTSA), Consumer Product Safety Commission (CPSA), or the U.S. Department of Agriculture (USDA) for example.

What are the benefits of Section 321?

Businesses can now clear large volumes of low-value parcels and save on duties. This process is less complex, although it is limited to <$800 value per shipment. To reach an up-leveled customs clearance experience, specialized software allows thousands of entries to be processed within minutes. That’s why we vouch for this perfect solution to accelerate ecommerce growth!

Can you clear Section 321 entry in any port of the United States?

Yes, ask your trusted customs broker how they do it! At G-Global, our remote filing capacity is an advantage to your logistics for fast clearance in any port, no matter where and when!

Check out the following resource on Section 321, provided by CBP for more understanding, here!

Calculate Your Savings!

Estimated Savings

Total

in Pro Version

Payment methods

pro Feature Availablein Pro Version

Credit Card details

pro Feature Availablein Pro Version

Your service request has been completed!

We have sent your request information to your email.Talk to our experts!

You'll benefit from our 105+ years of experience. We are ready to serve your business!

Fulfillment is just the beginning, let’s discuss how we can help you improve your profit.